Insurance companies are increasingly investing in technology to improve efficiency, enhance customer experience, and stay competitive. Here are some of the top technology investments and their objectives:

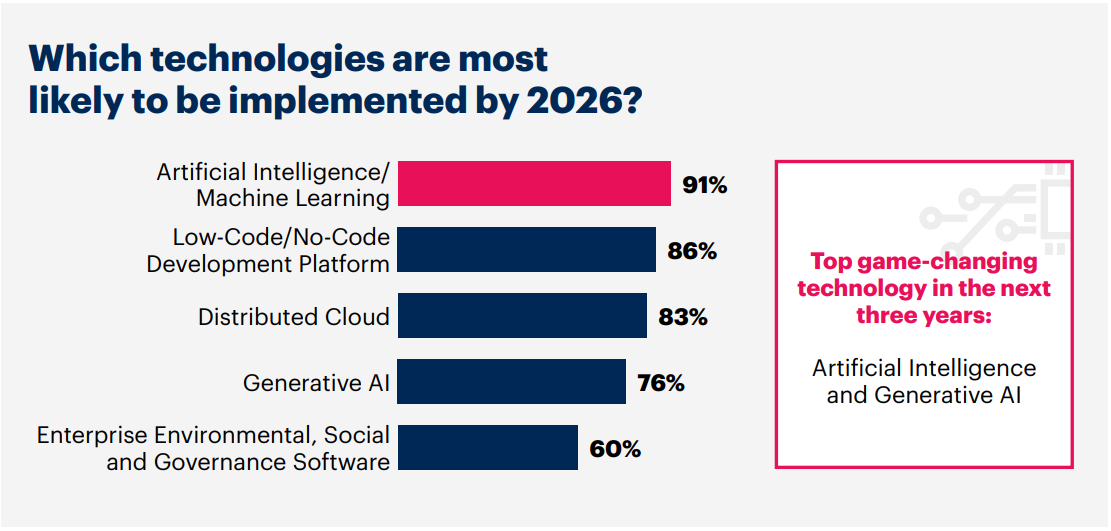

Source: gartnerweb

1. Artificial Intelligence (AI) and Machine Learning (ML)

- Objectives:

- Risk Assessment and Underwriting: AI and ML algorithms analyze vast amounts of data to improve risk assessment and underwriting accuracy.

- Claims Processing: Automate claims processing to reduce time and cost, and to improve customer satisfaction.

- Customer Service: Implement chatbots and virtual assistants to provide 24/7 customer support and handle routine inquiries.

2. Data Analytics and Big Data

- Objectives:

- Personalized Offerings: Use data analytics to offer personalized insurance products and pricing to customers.

- Fraud Detection: Identify patterns and anomalies that indicate fraudulent activity, reducing losses from fraud.

- Predictive Analytics: Forecast future trends and customer behavior to inform strategic decisions.

3. Blockchain Technology

- Objectives:

- Claims Management: Streamline and secure the claims management process, reducing the risk of fraud and errors.

- Smart Contracts: Automate and enforce contract terms, ensuring timely and accurate execution of policies.

- Data Security: Enhance the security and transparency of data storage and transactions.

4. Internet of Things (IoT)

- Objectives:

- Usage-Based Insurance (UBI): Monitor driving behavior, home security, and health metrics to offer UBI policies that reflect actual risk.

- Risk Mitigation: Use IoT devices to detect and mitigate risks in real-time, such as leak detectors in homes or wearable health monitors.

5. Robotic Process Automation (RPA)

- Objectives:

- Operational Efficiency: Automate repetitive tasks, such as data entry and document processing, to reduce operational costs and improve accuracy.

- Compliance: Ensure compliance with regulatory requirements by automating reporting and audit processes.

6. Cloud Computing

- Objectives:

- Scalability and Flexibility: Use cloud services to scale IT resources according to demand and enable remote access to systems.

- Cost Reduction: Reduce IT infrastructure costs and improve disaster recovery capabilities.

- Collaboration: Enhance collaboration and data sharing across different departments and locations.

7. Cybersecurity

- Objectives:

- Data Protection: Protect sensitive customer data from breaches and cyberattacks.

- Regulatory Compliance: Ensure compliance with data protection regulations and standards.

- Incident Response: Develop robust incident response plans to quickly address and mitigate the impact of cyber incidents.

8. Telematics

- Objectives:

- Improved Risk Assessment: Collect real-time data on driving habits to assess risk more accurately.

- Customer Engagement: Engage customers with feedback on their driving behavior and incentives for safe driving.

- Claims Efficiency: Use telematics data to verify claims and accelerate the claims process.

9. Digital Platforms and Mobile Apps

- Objectives:

- Customer Engagement: Provide customers with easy access to policy information, claims filing, and customer support through digital platforms and mobile apps.

- Sales Channels: Expand digital sales channels to reach a broader audience and improve customer acquisition.

- User Experience: Enhance user experience with intuitive interfaces and seamless interactions.

10. Advanced Analytics and Business Intelligence (BI)

- Objectives:

- Informed Decision-Making: Utilize advanced analytics and BI tools to gain insights into business performance and market trends.

- Strategic Planning: Support strategic planning and resource allocation with data-driven insights.

- Performance Monitoring: Monitor key performance indicators (KPIs) and track progress towards business goals.

Investing in these technologies allows insurance companies to stay competitive, improve operational efficiency, enhance customer experience, and better manage risks.

Read More: Top Technology Investments and Objectives for Insurance

Advertisement